Is Risk Killing Innovation?

If you’re working in a business today, regardless if you own and operate the business or have a senior level role within a private or public, corporate or government entity. We all know how important it is to assess, manage and ideally mitigate any exposure to risk across the business. More often we have simply considered this as a good business practice.

Most businesses today have developed a matured and well considered approach to managing risk. We know the alternative to this vigilant approach is considered both foolish and somewhat disturbing to any of the stakeholders that may have any material interest or relationship to or in the business.

Risk in most cases protects the business. It protects the business from going out of business. So, to suggest risk is killing the business may be an overstatement to some.

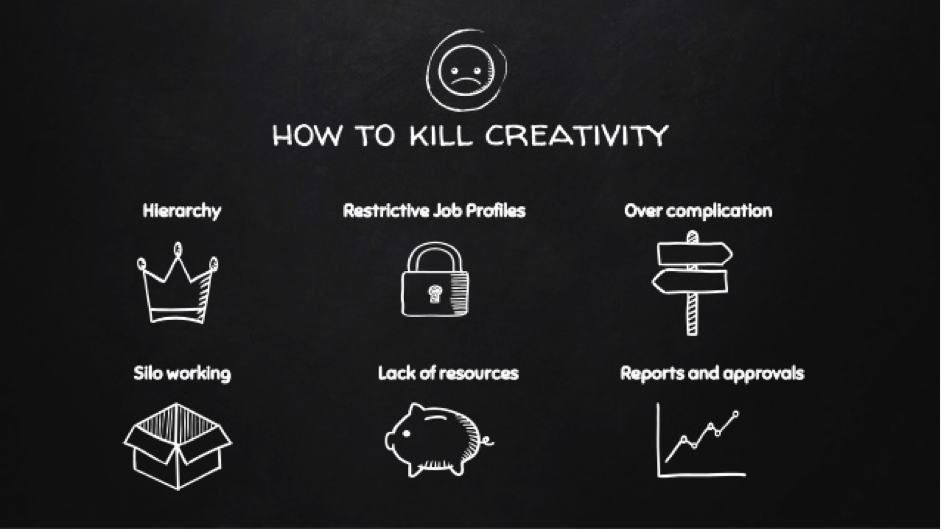

However, what we are seeing, is consistent evidence that risk, in fact is stifling or limiting innovation and innovative ideas in many business today. The main reason is that we have continually over-engineered our approach to see, act and manage risk. Today, as business professionals we view everything with a set of lenses around risk. Everything we see is framed around and cemented in risk.

To this end and although we know it shouldn’t be the case, risk is at the opposite end of the scale to innovation. Risk in some respect competes against innovation. Innovation or innovative ideas to some people extends the possibilities of risk. So, their natural reaction is to limit, stifle and even dismiss innovation or the ideas as nonsensical. That wouldn’t work, it’s too risky to try something new, we’ve always done it this way – would be the typical reply’s and answers to innovation.

Therefore, back to opening question, could risk be killing innovation? In some businesses, the answer is a clear – Yes.

In many of the forums, workshops and presentations that I’ve been fortunate enough to facilitate over the last couple of years. I have constantly found senior executives struggle to take their lens of risk off or out of the discussion when it comes to being innovative around a topic problem or potential solutions to a problem.

It is very difficult to bring forward and challenge new ideas and new thinking when you continue to find or explain reasons why you can’t do something. It is quite common to have the first 30 to 45 minutes of a conversation or as part of an ideation session where new ideas could be generated to hear constantly why the business can’t do something.

In all of these cases, the executive is trying to protect the business. They have an underlying risk aversion to change or something new. It appears to be an inbuilt mechanism for most. I must protect the business. It’s my job or it will be my job if I don’t protect the business. The alternative view is that risk is used to protect people (or in some cases the business) from change.

As is quoted very often, what is the most expensive eight (8) words in business?

The answer being – “this is how we have always done it”

Although this statement may not necessarily refer to being founded in risk. It certainly is used as a defence position in many situations where change may imply or amount to a level of uncertainty. In these situations, it is much easier for executives and the business to do nothing. This is far safer, it is less risky.

The other side of risk

So how does one think differently if they continue to limit themselves within the confines of how they have always thought. Seeing everything with a lens of risk is simply inhibiting innovation across most businesses today.

If understood more clearly innovation can in fact reduce or eliminate potential or ongoing risk in many businesses. The challenge is to see past the present. However, this may be a process of retraining or recalibrating the individual’s thoughts to think differently. To open their lens to a new future.

What we are seeing is future innovation or disruptive innovation that can in fact take current aspects of risk right out of the picture as current or past practices may become totally obsolete and areas of past risk become redundant in the future.

An example of this could be when two car users have a car accident. They may simply use their hand held mobile device to capture a photo of the other person’s driver’s license, GPS coordinates, date, time matching etc and attach an image of both the car registration plates and images of the damage to both cars. The same process is followed by the other driver. Both submissions are pushed (sent) to either the local/state or federal authorities or each of the individual’s insurance companies. This process may remove excessive paperwork, reduce labour for insurance repairs and accelerate insurance claims and payments.

This solution would obviously have to be tested but if successfully launched, we would expect the business to implement a different or new business requirement relating to levels of risk.

However, the key point from this example is to widen or think differently without using a lens of risk in the very earlier stages. Using risk as a starting point will only limit innovation, ideas and most importantly the ability to collaborate with others.