Today, many businesses across many industries are in an accelerated transition of change. This appetite to change is driven by their need to survive and prosper in a rapidly changing marketplace. This is no more evident than what is occurring across the Office Printing Industry globally.

Covid-19 has now exposed these floors even more visibly then before.

One of the many challenges or some would say legacies, that this industry has and continues to face. Is that of its wonderful success globally over the past 30 odd years.

From the office equipment manufacturers (OEM’s) through to every player and provider that operates as part of the channels to market. They have been a wonderfully successful sales and marketing driven business.

The business model metric

The business model that was driven via the OEM brands and many of the resellers and dealers provided the impetus to virtually saturate an ever-growing market. This lies the challenge.

A manufacturing based business must be fed. When products are in demand and markets are growing. Manufacturing is built to support output levels including peaks. The same strategy doesn’t usually apply when the direction of growth in going in the opposite direction.

Typically, when manufacturing volumes decline. You either do the following;

- invest in better automation to bring down costs,

- pressure partners for lower input materials,

- cut back on costs through labour reduction (staff cut backs, redundancies etc.),

- reduce or lean out the supply chain that reduces inventory levels or

- reduce overall manufacturing volumes,

- Or alternately a combination of some or all the above may apply.

However, the impact of such changes particularly in reducing manufacturing volumes. Is that the unit costs of manufacture go up. At some stage, there is a tipping point. If the tipping point occurs this will increase unit price and this will be most likely shared across regions and the globe.

Although in the past it was possible in terms when one region was in either a flat or declining market. Other regions could or would support the total manufacturing unit number. Thus, providing a level of support (or floor) to protect the global unit manufacturing costs.

Will Covid-19 increase this exposure even further?

This global support is less likely to occur in the future with falling unit and print volumes from most major markets. With Covid19 we will see a further impact to global unit volumes.

Even pre-Covid19 most global experts and data from companies like Nexera https://www.nexera.net/ were highlighting an increasing downward trend in office print volumes.

Unfortunately global office print volumes have been continuing to shift downwards for the last few years.

Some of the main reasons why print volumes have reduced are as follows;

- increased adoption of digital automation tools across businesses

- behaviour of consumers to consume digital content

- Lower business costs (improved productivity)

- Reduction in human errors

- provides the businesses with increased agility and flexibility

- Customer centricity – provide a better customer experience

Even with growth coming out of new geographical regions it will still not be able to underpin the impending impacts of the forthcoming decline.

The Butterfly Effect:

When manufacturing costs increase. They are often passed on through the channel and ultimately to the end customer. When this occurs, market demand can further decline as pricing is not as favourable in comparison to other brands. Providers (direct sales teams, dealers and resellers) that distribute, market and sell the higher cost product feel the effect as well.

Customers ultimately have the choice. When customers struggle to see the value or difference between one brand or the other, they will usually fall back to price.

Ultimately what occurs is the ripple effect (butterfly effect). We have had these effects in the office printing industry in the past but the ripple has always been so lightly felt. However, this is changing in a very dramatic way.

The accelerated decline of print

As print volumes continue to decline globally due to increasing digitisation and coupled with increasing device consolidation, the office print industry globally is on the tail-end of market maturity.

The impact will be that brands (OEM’s), print providers, dealers, resellers and co will be squeezed through tighter margins. Resellers and dealers may be the first to change or be impacted as many are on the front line and feel the effects first.

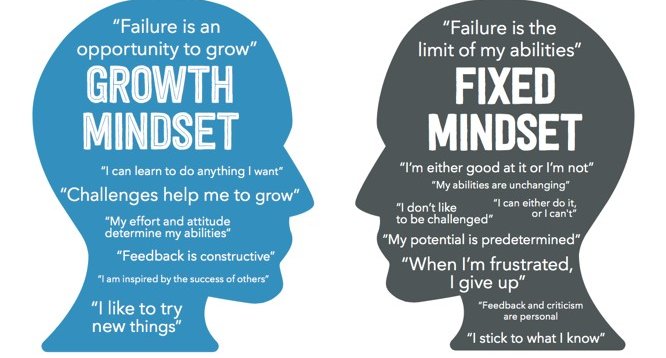

Some of the smarter businesses are doing just that – they are changing and they are being assisted by able business partners. However, the majority are still holding out and believing that the bath water is still warm. As a result by the time, some of these organisations recognise that the temperature has gone cold, it may be just too late.

So, we now know why this is happening, but what is the

larger impact to the industry?

Well the impact is this; the industry is currently feeling the effects of a shortening business model or manufacturing-based lifecycle. Instead of having a product (or product-set) having a manufacturing life-span of 20, 30 or 40 years like many manufactured based plants in the past. The office printing industry is now on the verge of a sharp fall. The product-set is running out of runway and I’m not referring to a new piece of hardware (kit) released every 5 years or a retooling the plant.

Obviously redesigning manufacturing plants to manage lower production cycles is an option, but it’s not going to be the strategy of all the remaining players. Maybe the last one or two within the industry sector can play this game. The others must take a different path, deploy a different strategy.

The Market Maturity tail is shortening:

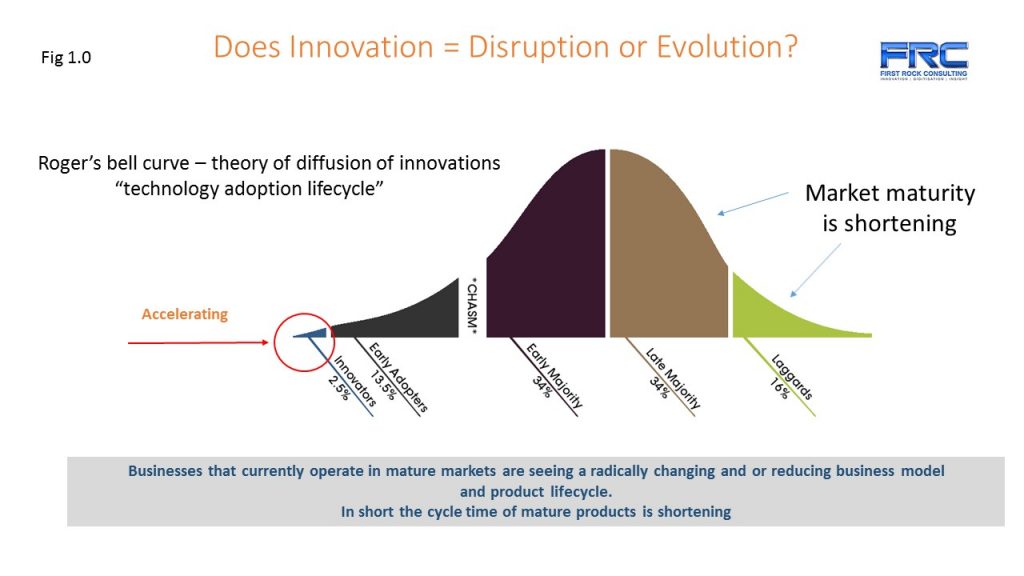

Although the Rogers Bell Curve (fig 1.0) is about the technology adoption lifecycle it is equally useful to illustrate the focus on innovation. The reason why innovation has become increasingly important is more related to the shortening of products in market at the back end of the cycle.

If you have a shortening cycle or your product matures quicker the focus and attention must be on renewing or innovating faster. Many industries and the office printing industry is one of them, is now seeing the full effects of a shortening or decreasing market-life-span.

This is not to say that (office printing industry) will disappear anytime soon, because it won’t. It will continue to be exist, but not the way it has done in the past. We are now in one of the latter phases of a flattening market (short market tail). We are and will continue to see brands (manufacturers) consolidate.

New leadership is required for unchartered territories

Today in fact, we are witnessing some of the most successful global brands pivoting and refocusing their direction on a new future. They are either exiting the office print industry altogether, merging or being acquired by another office printing brand. Some are choosing to split parts of their business to either refocus their attention to new adjacent markets or create a new play in a new market.

Some have also recognised that breaking the business up helps to create and make transparent a new asset value (class) that was previously was trapped in a somewhat slowing decaying carcass. Maybe this is more of a push to satisfy shareholders or to take advantage of available investment funds.

Whatever the reason the office printing is presenting at an inflection point.

Where to from here?

Well, the playing field is certainly changing, innovation has sped up. In fact, it has accelerated at phenomenal rates due to the realisation that businesses can no longer launch an innovative product (or business) in market and watch it have a 30 plus year (tail) run. It is more likely that it will be obsolete, redundant or disrupted within 5,10 or 15 years.

Due to the shorter life, organisations are looking at innovative (and some disruptive innovation) to sustain their growth. Incremental innovation (e.g. a faster more powerful processor or better process improvement) won’t be enough. The focus must be on leap-frog innovation – innovation that takes a “design thinking” perspective rather than looking at today’s environment requirements only.

Parallel to this changing dynamic is the increasing emphasis on aligning businesses to a customer centric view, or businesses focused on the future industries that are evolving such as the “customer immersion industry” or the “customer experience industry”.

We are seeing many clients, customers and consumers around the world, continue to be educated and conditioned around the benefits of such permeating technologies led by an assortment of technology players who provide solutions and experiences in the areas of mobility, big data, cloud, virtual reality, augment reality, analytics, IoT, 3D, Drones, AI and the list goes on.

The speed of Innovation Acceleration has increased

This accelerated appetite of innovation takes advantage of technology infrastructures, platforms and applications that are driven and leveraged by a variety of existing and new technologies and customer centric business models.

Additionally, the ability to compete and gain access to low cost technology is changing the way both new and old businesses compete. Green field businesses are now disrupting older, well entrenched businesses of the past. Business that have been successful in the past are now being eroded by new entrants that are using technology and low cost models to outcompete the competition.

Businesses that have built a successful business on decades of experience and infrastructure are being challenged by businesses that don’t carry dedicated workforces or don’t carry legacy infrastructure to operate. They scale, their agile and deploy quickly. They are becoming the new norm.

They operate on an agile business model and are changing the way they engage their customers. These new business models are shaped around being more customer centric, engaging at an individual level, they can respond at a faster rate and at a deeper level through predicative analytics.

Therefore, the question that now remains is how is your business going to adapt going forward? How are you going to drive leap-frog innovation, not just incremental change? The way you have always done things in the past, does not mean or guarantee you success in the future.

As someone was said to me “if nothing changes, nothing changes”